Standard Deduction 2022 Form 1040 . the irs also announced that the standard deduction for 2022 was increased to the following: For 2023, the standard deduction was. the 2022 standard deduction for married filing jointly is $25,900. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Single taxpayers and married individuals filing separately:. Individual income tax return 2022. The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17.

from refundtalk.com

Individual income tax return 2022. the irs also announced that the standard deduction for 2022 was increased to the following: the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. the 2022 standard deduction for married filing jointly is $25,900. For 2023, the standard deduction was. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. Single taxpayers and married individuals filing separately:.

Tax Changes Effective for 2022 Returns ⋆ Where's My Refund? Tax News

Standard Deduction 2022 Form 1040 The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. For 2023, the standard deduction was. Individual income tax return 2022. Single taxpayers and married individuals filing separately:. the irs also announced that the standard deduction for 2022 was increased to the following: the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the 2022 standard deduction for married filing jointly is $25,900. The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill.

From www.addify.com.au

The Standard Deduction 2022 Everything You Need to Know Addify Standard Deduction 2022 Form 1040 the irs also announced that the standard deduction for 2022 was increased to the following: The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. Single taxpayers and married individuals filing separately:. Individual income tax return 2022. the standard deduction is a specific dollar amount that reduces the amount of income on. Standard Deduction 2022 Form 1040.

From 1040taxrelief.com

2022 Tax Rates, Standard Deduction Amounts to be prepared in 2023 Standard Deduction 2022 Form 1040 Single taxpayers and married individuals filing separately:. the 2022 standard deduction for married filing jointly is $25,900. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. For 2023, the standard deduction was. Individual income tax return 2022. The standard deduction is the portion of income not subject to tax. Standard Deduction 2022 Form 1040.

From projectopenletter.com

2022 Federal Tax Brackets And Standard Deduction Printable Form Standard Deduction 2022 Form 1040 For 2023, the standard deduction was. the irs also announced that the standard deduction for 2022 was increased to the following: Single taxpayers and married individuals filing separately:. the 2022 standard deduction for married filing jointly is $25,900. the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. Individual income. Standard Deduction 2022 Form 1040.

From www.employementform.com

Self Employment Tax Form 2022 Standard Deduction Employment Form Standard Deduction 2022 Form 1040 Single taxpayers and married individuals filing separately:. For 2023, the standard deduction was. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Individual income tax return 2022. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. the. Standard Deduction 2022 Form 1040.

From www.cpapracticeadvisor.com

Taxpayers Should Take These Steps Before Filing Taxes CPA Standard Deduction 2022 Form 1040 The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. the irs also announced that the standard deduction for 2022 was increased to the following: For 2023, the standard deduction was. the 2022 standard deduction for married filing jointly is $25,900. Individual income tax return 2022. The standard deduction is the portion. Standard Deduction 2022 Form 1040.

From worksheets.clipart-library.com

Standard Deduction Worksheet for Dependents walkthrough (IRS Form Standard Deduction 2022 Form 1040 The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. For 2023, the standard deduction was. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Individual income tax return 2022. the irs also announced that the standard deduction. Standard Deduction 2022 Form 1040.

From cefpjdkt.blob.core.windows.net

Standard Deduction 2022 Business at Richard Gutierrez blog Standard Deduction 2022 Form 1040 the irs also announced that the standard deduction for 2022 was increased to the following: the 2022 standard deduction for married filing jointly is $25,900. Single taxpayers and married individuals filing separately:. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. For 2023, the standard deduction. Standard Deduction 2022 Form 1040.

From refundtalk.com

Tax Changes Effective for 2022 Returns ⋆ Where's My Refund? Tax News Standard Deduction 2022 Form 1040 the 2022 standard deduction for married filing jointly is $25,900. Single taxpayers and married individuals filing separately:. The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. Individual income tax return 2022. the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. the irs. Standard Deduction 2022 Form 1040.

From www.withholdingform.com

Nys Withholding Tax Forms 2022 Standard Deduction 2022 Form 1040 For 2023, the standard deduction was. Individual income tax return 2022. the irs also announced that the standard deduction for 2022 was increased to the following: the 2022 standard deduction for married filing jointly is $25,900. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Single taxpayers and. Standard Deduction 2022 Form 1040.

From printablefullminis.z13.web.core.windows.net

Standard Deduction 2022 Worksheet Standard Deduction 2022 Form 1040 Single taxpayers and married individuals filing separately:. Individual income tax return 2022. the 2022 standard deduction for married filing jointly is $25,900. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. For 2023, the standard deduction was. the standard deduction is a specific dollar amount that. Standard Deduction 2022 Form 1040.

From www.alamy.com

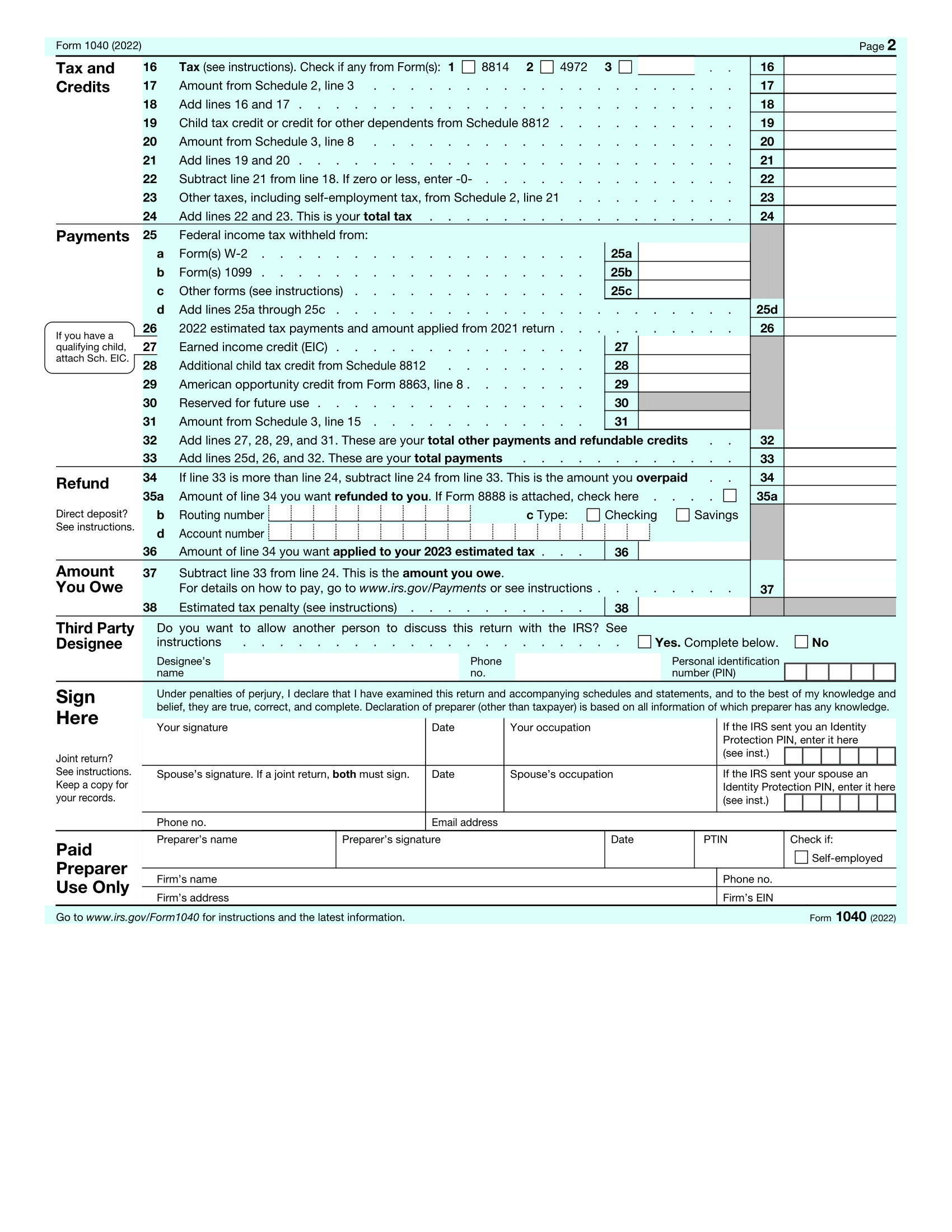

An IRS 1040 tax year 2022 form is shown, along with an ink pen Standard Deduction 2022 Form 1040 For 2023, the standard deduction was. the irs also announced that the standard deduction for 2022 was increased to the following: Single taxpayers and married individuals filing separately:. the 2022 standard deduction for married filing jointly is $25,900. The standard deduction is the portion of income not subject to tax that can be used to reduce your tax. Standard Deduction 2022 Form 1040.

From gbu-presnenskij.ru

What Is Form 1040? Definition And How To Fill It Out, 47 OFF Standard Deduction 2022 Form 1040 the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. Single taxpayers and married individuals filing separately:. the irs also announced that the standard deduction for 2022 was increased to the following: The standard deduction is the portion of income not subject to tax that can be used to reduce. Standard Deduction 2022 Form 1040.

From classzoneshaveling.z22.web.core.windows.net

Simplified Method Worksheet 2022 Standard Deduction 2022 Form 1040 the irs also announced that the standard deduction for 2022 was increased to the following: the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. Single taxpayers and married individuals filing separately:. The standard deduction. Standard Deduction 2022 Form 1040.

From www.pdffiller.com

Fillable Online 2022 Form 1040SR Fax Email Print pdfFiller Standard Deduction 2022 Form 1040 the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. Individual income tax return 2022. the 2022 standard deduction for married filing jointly is $25,900. For 2023, the standard deduction was. the irs also announced that the standard deduction for 2022 was increased to the following: the standard deduction. Standard Deduction 2022 Form 1040.

From www.pdffiller.com

2022 Form IRS 1040 Schedule 1 Fill Online, Printable, Fillable, Blank Standard Deduction 2022 Form 1040 the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. Individual income tax return 2022. the irs also announced that the standard deduction for 2022 was increased to the following: Single taxpayers and married. Standard Deduction 2022 Form 1040.

From brighttax.com

How to Complete Form 1040 With Foreign Earned Standard Deduction 2022 Form 1040 the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. the irs also announced that the standard deduction for 2022 was increased to the following: The standard deduction is the portion of income not subject to tax that can be used to reduce your tax bill. Single taxpayers and married individuals. Standard Deduction 2022 Form 1040.

From bench.co

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting Standard Deduction 2022 Form 1040 the total of your itemized deductions is reported on schedule a (form 1040) itemized deductions, line 17. Single taxpayers and married individuals filing separately:. the 2022 standard deduction for married filing jointly is $25,900. The standard deduction for taxpayers who don't itemize their deductions on schedule a (form 1040) is. Individual income tax return 2022. the irs. Standard Deduction 2022 Form 1040.

From printableformsfree.com

2023 Form 1040 Instructions Printable Forms Free Online Standard Deduction 2022 Form 1040 For 2023, the standard deduction was. Individual income tax return 2022. the standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed. the irs also announced that the standard deduction for 2022 was increased to the following: the 2022 standard deduction for married filing jointly is $25,900. Single taxpayers and. Standard Deduction 2022 Form 1040.